1,5 min read –

Opportunity in Diversity –

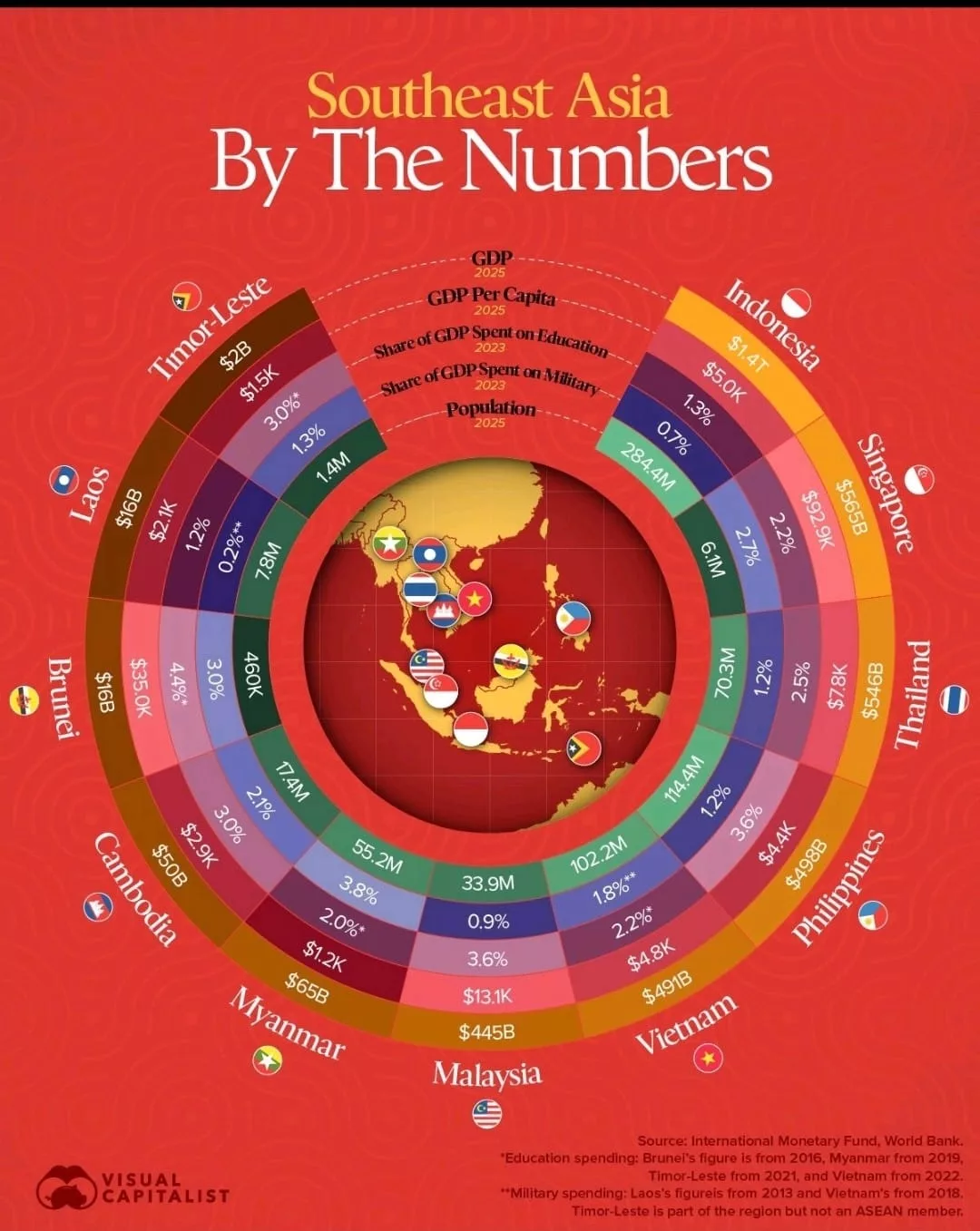

ASEAN by the Numbers –

What the Data Reveals

This macroeconomic snapshot of Southeast Asia highlights striking contrasts across the region.

Below is a country-by-country breakdown of key strengths and weaknesses based on :

➡️ GDP size

➡️ Population

➡️ GDP per capita

➡️ Military spending

➡️ Education spending

Indonesia

✅ Largest GDP and population by far, a massive domestic market, and regional heavyweight.

❌ Low education spending (lowest just after Laos) is reflected in the persistent shortage of qualified middle managers.

Singapore

✅ Exceptionally high GDP per capita, a regional outlier, the financial and high-tech hub of ASEAN.

✅ Small population limits scale but strengthens focus on productivity and specialization.

Malaysia

✅ Strong mid-range GDP with competitive GDP per capita.

✅ Balanced education and military spending, showing stable long-term planning.

Thailand

✅ Large economy and population, giving strong market depth.

☑️ Moderate GDP/capita, showing potential but also structural stagnation.

Philippines

✅ Fast-growing, young population, a clear long-term asset.

❌ GDP per capita remains low, indicating productivity challenges.

Vietnam

✅ High growth engine with robust GDP expansion.

☑️ Relatively low GDP/capita, but rising quickly as industrialization accelerates.

Myanmar

✅ Significant population size, offering future consumption potential.

❌ Very low education spending is a major constraint.

Cambodia

✅ Dynamic, young workforce and improving industrial base.

☑️ Low GDP per capita signals a long development road ahead.

Laos

❌ Small population and low GDP, limiting market potential.

❌ One of the lowest education spending ratios, weakening competitiveness.

Brunei

✅ High GDP per capita, driven by energy wealth.

☑️ Very small population, creating a niche but limited market.

Timor-Leste

☑️ Tiny economy, early-stage development.

❌ Low education spending, limiting human-capital growth.

ASEAN is not one market, but 11 distinct countries with radically different sizes, incomes, and capabilities.

If you export or want to export to ASEAN, you should:

🔸Adapt positioning to income levels and education depth.

🔸Prioritize Indonesia, Vietnam, Malaysia, and the Philippines for scale.

🔸Work with strong local partners who can navigate regulatory complexity and cultural differences.

This ASEAN diversity is a challenge, but also the region’s greatest opportunity.

We are CINTASIA, and we help you develop your sales and operations successfully in Indonesia.

We specialize in technology and industrial equipment.

PS: If you enjoyed this article, check out our blog for more. We have published 160+ other articles.

Go to https://cintasia.com/news-insights/

Picture and source: Visual Capitalist